Federal Trade Commission Safeguards Rule

The Federal Trade Commission (FTC) Safeguards Rule is a critical framework that mandates the protection of customer information. It applies to a wide array of financial institutions under the FTC’s jurisdiction. Since its inception in 2003, the rule has been updated to reflect the evolving landscape of technology and to provide clear, actionable guidance for businesses.

Does this rule affect you?

To be honest, this question shouldn’t really matter. The fact is that any business that stores data about its customers should at least know what this rule contains because it will help when considering just how much exposure is too much. That being said, take a moment to assess if your business is classified as a non-banking financial institution under the Safeguards Rule. The rule extends to a diverse set of businesses, not just traditional financial entities. Recently added to the list are:

- Retailers offering customer credit

- Property appraisers

- Check cashing service providers

- Tax preparation firms

- Auto dealerships with financing or leasing services

- Real estate settlement companies

Don’t leave it to chance - delve into the full Safeguards Rule and seek expert legal counsel to precisely understand your compliance requirements.

How to comply

Establish, implement, and maintain an information security program that is tailored to the size and complexity of your business. This program should act as a bulwark, incorporating administrative, technical, and physical safeguards to defend customer information.

Key Elements of an Information Security Program

- Appoint a discerning Qualified Individual to take the helm of your security program. This individual should possess the expertise to navigate the complexities of information security and the leadership to implement strategic safeguards.

- Engage in comprehensive risk assessments that meticulously identify and evaluate potential threats and vulnerabilities. This proactive approach is vital to fortifying your defenses against security breaches.

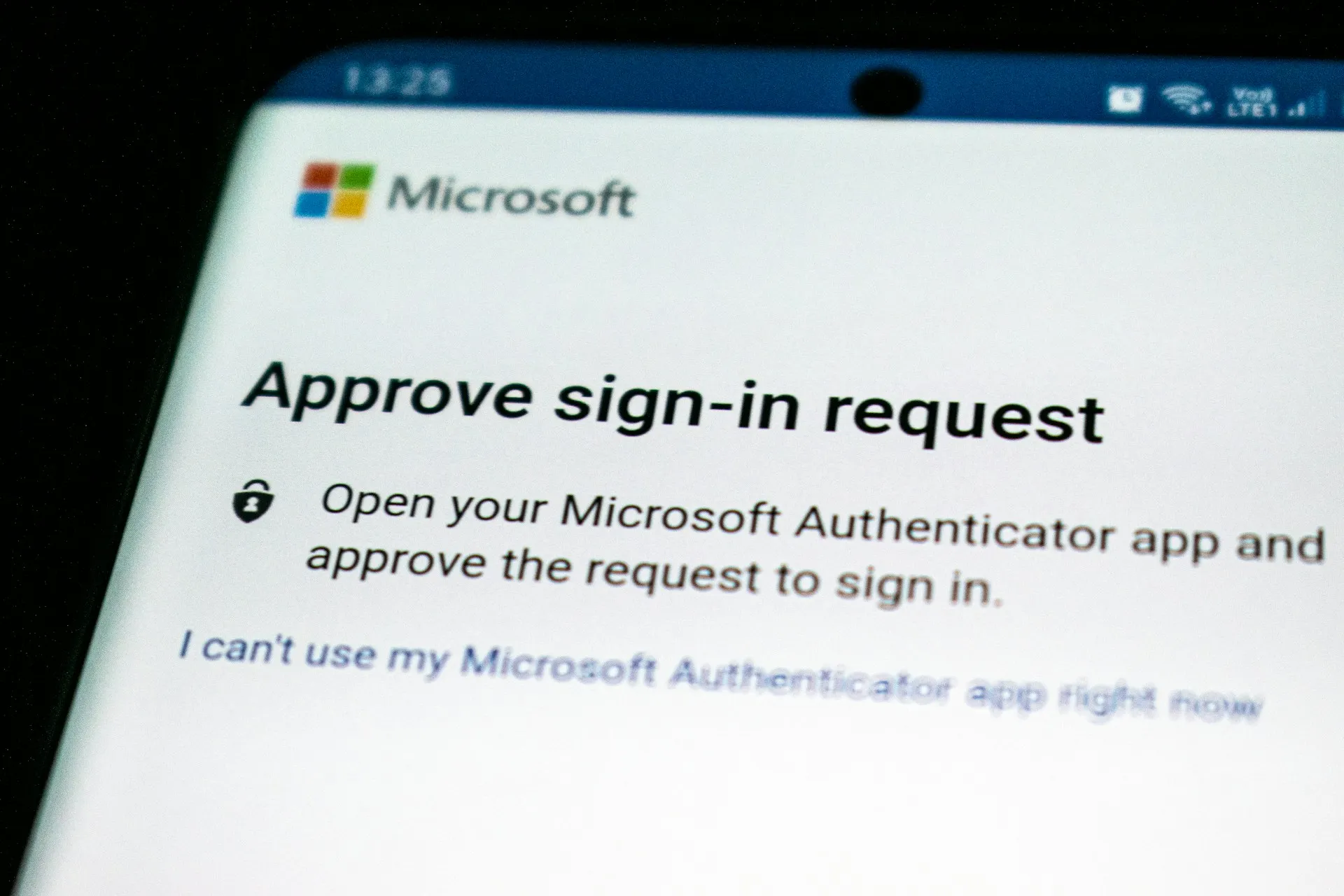

- Implement state-of-the-art data protection measures, including stringent access controls, advanced encryption techniques, and multi-factor authentication, to create a robust security infrastructure.

- Cultivate a pervasive culture of security within your organization by providing ongoing training to employees. Ensure that adherence to security protocols is continuously monitored and enforced.

- Regularly audit and refine your security measures to confirm their effectiveness. This commitment to excellence ensures that your safeguards remain impenetrable and up-to-date.

- Update your security program regularly to keep in step with the rapid pace of technological innovation and operational shifts.

- Develop a comprehensive incident response plan that is ready to be deployed at a moment’s notice. This plan should outline clear procedures for addressing and mitigating the impact of security incidents.

- Appoint a Qualified Individual who will provide regular updates to your Board of Directors or senior management regarding the company’s compliance with the security program.

It is crucial for businesses to understand the FTC Safeguards Rule even if compliance isn’t required, to protect their customers’ sensitive information and maintain trust. By proactively addressing these aspects, companies can fortify their defenses and demonstrate their commitment to security.